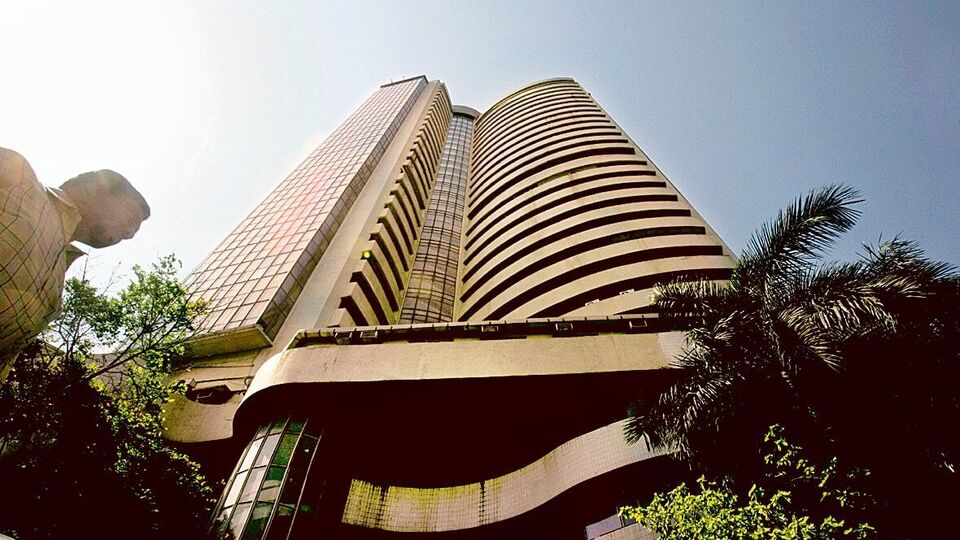

Stock Market Today: Sensex Sensx, Nifty .. End of a series of loss

The Indian stock market was overturned on March 17 after last week’s instability. Financial, pharma and auto share ended with benefits. The market is increasing profits from the beginning. The rally, which appeared on Wall Street last Friday, spread to the Asian markets on Monday. In addition, new measures declared by China to increase domestic use have further inspired the rally of domestic metal shares.

This, oil and gas shares also reversed to some extent. However, FMCG and realty stocks continued to decline. Mid and small-cap stocks have now rebounds since last week. The rally was also supported in the US Dollar Index. This is currently at the low of 5 -sheen. Professional uncertainty and growing financial concerns in the US are putting pressure on currency.

Against this background, the Nifty rose 0.50%to 22,508. Its 2 -day decline end. Sensex rose 0.46% to 74,169 points on Thursday. Its 5 days loss ended. The Nifty Midcap 100 index rose 0.70% to 48,461 points. The Nifty Smallcap 100 index rose 0.48% to 14,968 points.

Pharma share bright

Nifty Pharma has shown high benefits in 13 major region’s indices. Ended with a profit of 1.56%. Out of the 20 parts of the index, 19 benefits ended. Dr. Reddy’s laboratories, Granules India and Biocon topped the list up to 4%. Following a large sales pressure last week, the Nifty Auto firmly retaliated with a gain of 0.91%. Other region’s indices such as Nifty Metal and Nifty Consumer Durables finished the session with a profit of 0.23% and 0.77%.

The Nifty media continued to decline in the third consecutive season. Another 0.65% fell. The Nifty Realty also continued to decline for the third consecutive day. 0.38% fell.

Commenting on the performance of today’s market, Geogit Financial Services Research Head Vinod Nair said, “The national market has experienced a positive trade session. This is due to health care and strong performance in economic fields. However, due to tariff’s uncertainties, domestic investors include low in a range in the near future, ”he said.

“The stock market revolts on the basis of signs of profit growth. It is good to improve domestic economic indicators. There are hopes that investors can maintain the current situation due to the dangers of inflation associated with tariff uncertainties. The next Fed and BOJ meetings are closely monitored, ”they explained.

technical approach

A research in Religare Broking SVP Ajit Mishra said, “The Nifty 50 is now looking for a decisive trigger to overcome a 20-day experiencedly moving average (Dema) near 22,600. Although power supports emotions in banking and financial major institutions, it is limited to the lack of performance of other weighty areas. It is our opinion that it is necessary to focus on share selection based on relative power in terms of consolidation and wait for further clarity.

(Deny, The opinion and recommendations mentioned in this article are individual analysts. They do not mention the ideas of India time. We advise investors to consult authorized professionals before taking any investment decisions ..)